#14: The decade of rolling (poly)crises

A look at the biggest events of 2023, things to look out for in 2024, and resources to be prepared for a tumultuous decade.

[Author’s note: It’s been just over a year since this newsletter started, and it has far exceeded expectations over that time, approaching 600 subscribers from 15+ countries.

Thank you for those that have stuck around since the early days and welcome new readers — we hope this continues to offer value in a market increasingly inundated with content. Always appreciate receiving feedback on content, style, and other attributes so please feel free to share!

Also, if you have never done so thus far, please share this or your favorite piece with your networks and on social media. This is a free labor of love so helping expand outreach would be considered a token of appreciation.

With that, hope you have an incredible 2024!]

In late 2022, our first piece explained how the era of globalization was over, and to comprehend what was breaking, we first needed to realize how the global system was delicately balanced atop a few critical elements: energy, materials, finance, and supply chains. 2023 served that thesis well, and hopefully, our analysis helped you not just navigate the myriad of unprecedented events as they unfolded, but also recognize the failure of mainstream media and narratives in being able to understand what was happening:

Where mainstream narratives were totally wrong: De-dollarization and how either the Yuan or some BRICS, gold-backed currency was going to replace the US$. They were also wrong about inflation and debt in the Global North.

Where mainstream narratives were insufficient: Understanding why fossil fuels continued to hit all-time highs, the risk of supply chain disruptions, the ongoing genocide, etc.

What mainstream narratives ignored: Chart-shattering extreme weather events, the death of 1.5C global heating target, etc.

In all these topics and more, our analysis has been geared to serve people who look at the whole through a myriad of lenses, ranging from policy, politics, financial decisions, business opportunities, activism, and general knowledge. Would love to hear feedback on ways to improve delivering this service!

The philosophy behind this newsletter continues to be simple: there is a lot of crazy stuff that is happening and ramping up, which is not only driving polarization across all sorts of social identities higher, but it is also causing real, physical harm to so many people. It is easy to get lost, disillusioned, and apathetic through this combination of overstimulation and powerlessness — this is why anxiety and its corollaries are surging higher. One of the first steps to bring back hope and motivation is to be able to understand how the world works so that we can then either take protective measures and/or better choose our role in making it better. That is what this newsletter is about. Knowledge is a powerful tool, and for too long we have been castrated by being given deceptive tools that only made us complicit in our own suffering.

“Men make their own history, but they do not make it just as they please; they do not make it under circumstances chosen by themselves, but under circumstances directly encountered, given and transmitted from the past.” — Marx

“Pessimism of the intellect, optimism of the will.” — Gramsci

This piece has 3 parts:

Our overall thesis

Top events of 2023 and what to look out for in 2024

Best resources for 2024 and beyond

I. Our thesis

Long-time readers of this newsletter will know that the first ~10 pieces focused on laying the groundwork for explaining the base layer. What’s common across each of the elements below is that although they are different types of things, they are all at the bottom of the explanatory food chain — i.e. the building blocks that can only change form but can never not exist — and they are incredibly hard to reconfigure.

The thesis can be explained in 3+1 parts:

First, the pitchforks are coming because increasing volatility in the base layer has caused people’s access to basic needs such as food, heating, security, etc. to become harder, thereby breaking the delusion that we all live under some meritocratic system where if you adopt the right liberal values, prosperity would come your way. Rampant inequality, increasingly glaring contradictions, and being squeezed even harder than usual because of energy shortages, inflation, climate change, etc. are what spark the fire and bring out angry, disenfranchised people onto the streets. Hence, the pitchforks.

Second, the liberal elite gets booted out and the right-wing fills the gap (for the most part). All systems are built on trust and deference, so as the masses turn against the elite, a power vacuum emerges. and people start looking for whatever reactionary, anti-elite narratives and movements they can find. You can narrow down potential alternatives to two broad types: right wing and left wing. Note: liberals and leftists are two totally different groups. In today’s world, given that left-wing movements have faced 50 years of non-stop suppression, the most organized anti-elite forces are right-wing, often far-right, movements. Hence, in many cases expect the far-right to fill that vacuum politically — Trump, Bolsanaro, Milei, Modi, etc. — as well as socioculturally, which you can see with the rise of Jordan Peterson, Ben Shapiro, Chris Ruffo, etc.

This is the part where whatever progress we have made on social, climate, economic, etc. topics over the past few decades can easily get undone. For example, just look at Roe v. Wade in the US, the resurgence of anti-immigration politics, the u-turn of fossil fuel companies and financial institutions on the importance of oil and gas, etc.

Third, the dying system doesn’t go down without a fight and lashes out. There are two ways for them to resist: partner with far-right leaders to protect their interests (which is what Bolsanaro, Modi, etc. are/were given their close alignment to the rich); and/or double down and increasingly turn towards suppression and coercion. The second option is what we are more likely to see, and are already seeing across the board with more blatant war/genocidal actions, surging us-vs-them rhetoric, etc. It’s the lashing out of someone knowing they are drowning. Sadly, that someone is a social group with tremendous wealth and power at their disposal, which is why things are getting increasingly violent and unhinged.

Based on the past year, it is relevant to add a fourth part to this, which is that this is also a time of incredible technological breakthroughs, and yet we are a civilization that severely lacks wisdom and maturity. AI and quantum computing are the biggest game changers we have had in a while and will redefine so many critical sectors, including medicine, energy, entertainment, etc.

Note: We don’t want to pile onto the AI bandwagon here as there is too much premature froth and excitement; however, over the next decade or so we expect big impacts.

We have this remarkably powerful tool at our disposal, but what comes out of any tool is a function of the socioeconomic setup under which it operates. How will these tools be used in a broken system that is shaped by the hypothesis mentioned above? Even if this wasn’t a decade when the global system was breaking, will our overall civilizational “full-steam ahead, no holds barred” type approach just use these tools to accelerate into hitting a wall? Who will benefit and who will face even more exploitation?

[More on this 4th part in the future but highly suggest listening to the experts on this — suggestions in the resources section]

In a world where all this is already happening, understanding things as they are is critical, although insufficient on its own, to not just protect yourself but also contribute to a better tomorrow. Hopefully, we are playing a small part in that.

II. Hot topics

Here is our list of the biggest events in 2023 and the top 3 to look out for in 2024, by base element:

Energy, raw materials, and supply chains

Top stories of 2023:

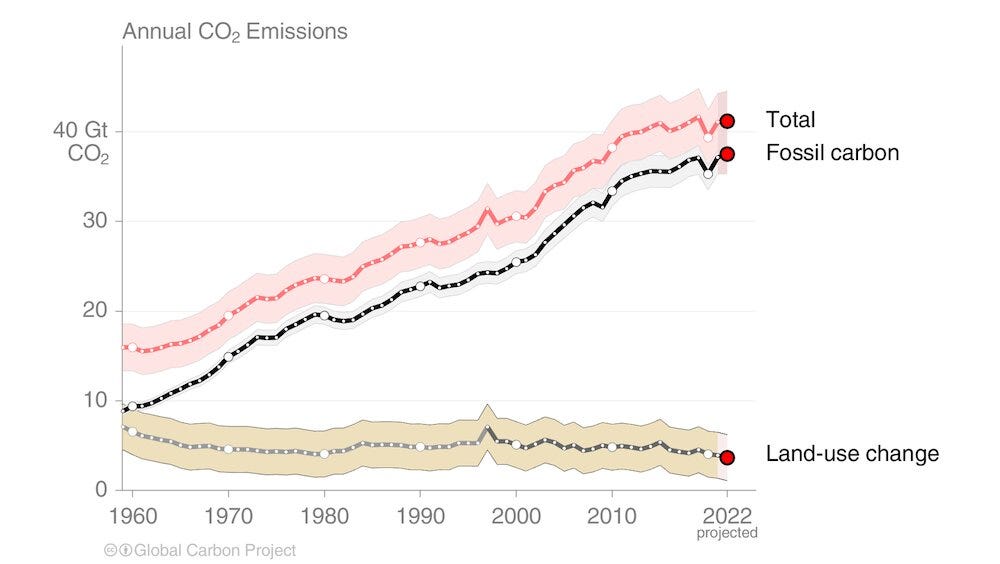

Fossil fuels (and CO2 emissions) hit all-time highs: Despite the narratives, the investment, and the technological progress, oil and coal (!) reached their highest levels of global consumption. This was very much predictable though if one understands what makes FFs special (see newsletter #6) and how the current systems aren’t designed to simply replace these energy sources with wind & solar seamlessly (see newsletter #13). The Norway and California case studies, as renewable energy leaders, offer valuable insights.

The rise of the US and China as major energy players: Typically we think of the Gulf countries, Russia, etc. (OPEC countries) as the countries with the most market power in the energy space, given the supremacy of oil and the reliance on these countries for supply. 2023 was a year when this started to shift. In short, the US became the world’s largest producer of oil (10-15% of global supply, up to 20% if you include natural gas liquids) as shale oil production roared back. This doesn’t mean the world depends on US supply because the key metric for that is net exports, where the US is still behind countries like Saudi Arabia because it has to import certain grades of oil it doesn’t produce. However, this supply capacity, along with friction between OPEC countries, has severely reduced the pricing power of OPEC. Oil is still supreme, but the way the global market is structured has dramatically shifted.

On the other hand, China’s leading role doesn’t come from it being a supplier of energy resources, but from having an iron grip on the supply chain for a variety of raw materials that are critical for electrification, decarbonization, industrial development, etc. Their dominance runs across the board, from nickel, cobalt, tungsten, and lithium to rare earth metals. As the world’s largest consumer of these materials (by far), countries that export these are dependent on China’s demand, while countries that use the processed version of these materials are dependent on China’s ability to refine and process these materials. This developing dynamic isn’t at the same level as oil in the 1970s — simply because raw materials are an eclectic group of substances and can’t be centralized the same way — but it is going to have similarly major implications on the global system.

(Extremely) extreme weather & the death of the 1.5C target: Across all the main climate metrics, e.g., land temperature, sea surface temperatures, etc., 2023 was a record-breaking year, beating even the expected levels of global heating. This is because of a combination of two things: reduced aerosols (e.g., sulfur dioxide) because tragically these air pollutants helped reflect sunlight and cool the planet; second, switching from La Nina to El Nino, which typically results in higher than trend temperatures (see newsletter #9).

As more heat is absorbed due to increasing GHG emissions and less heat is reflected due to lower aerosol emissions, global heating is accelerating! This can kick off feedback loops (e.g., higher ocean temperatures melt more ice which then leads to less sunlight being reflected and more being absorbed by the water, causing more heating) and push us over tipping points. More heat means more energy for storms (more rain, faster wind) in some places, while it means dryer air, and hence wildfire risk, in others.

Supply unchained: If supply chain disruptions were bad in 2022 because of the Russia-Ukraine war, 2023 kicked it up to a whole new level. That front continues to remain open, with new issues raised in the Middle East with disruptions related to the Israeli genocide and the reaction of Houthis in the Red Sea. Commodity trading is always a high-risk, high-reward business, but it relies on a certain degree of predictability and routine because of the volume of stuff that needs to be moved around, as well as the complexity of managing all the routes, the equipment, etc. It is said that the most important institution in global trade over the past 50 years has been the US Navy because it, for better or for worse, was able to dominate trade routes and keep them stable. Now that confidence is missing and more fractures in the system emerge.

This isn’t just about sea routes by the way; other examples include the revolt in Niger and the new government’s reluctance to supply France with Uranium (60% of French electricity comes from nuclear and Niger is a top 3 supplier). Lastly, this also isn’t just about geopolitical disruptions. Underinvestment in the industry and long-lead of new mines has limited the speed with which supply can be ramped up at a time when demand is exacerbating.

Therefore, longer wait times, longer routes, higher insurance costs, demand-supply gaps, etc. will all have huge ripple effects across the global system, impacting prices and who gets what when.

For 2024, we expect these trends to continue and have chosen 3 big things to look out for:

First major heatwave catastrophes: The extreme weather situation gains momentum as this might be the year that the El Nino is in full flow. The past few years have already seen terrible heatwaves across the globe, major floods, terrible wildfires, etc. but 2024 may be the year that we have a real phase shift in the intensity of these events. Thinking along the lines of The Ministry Of The Future here.

The climate counterrevolution gains steam: In previous pieces, we have argued that the current climate movement relies too heavily on platitudes and reductive “win-win” situations; this might be the year that those start to unravel as the “other side” uses these failures (e.g., the offshore wind news in the UK), along with the growing chatter around energy security”, to undermine efforts to decarbonize. Remember, growth in renewables doesn’t matter if fossil fuels are growing in tandem!

At the same time, we may also begin to realize, at the mainstream level, that a lot of the technologies that the current climate movement relies on aren’t as rose-tinted as they seem. Examples of this include busting the myth around how much cleaner natural gas really is compared to coal since we don’t have a good way of accounting for methane leaks, the viability of carbon capture (even through natural systems) and how our ability to ramp it up by 2050 is grossly exaggerated, and the limits of hydrogen as the messianic fuel (energy carrier) that will decarbonize the hard sectors like aviation and steel manufacturing.

The resurgence of nuclear energy: This warrants a whole piece but in the struggle to achieve the dual goals of decarbonization and cheap, stable energy supply, nuclear energy stands out as a clear winner. We are not propagating it as a solution (we will discuss that in a future piece) but the trend towards nuclear is undeniable. There was a pledge at COP28 to 3x nuclear energy capacity by 2050, nuclear-skeptic countries like Japan are looking to restart idle plants, and China is leading the way with expanding nuclear capacity and innovating on plants of various sizes. Expect a lot more demand to be announced for nuclear in 2024, while at the same time, supply is dreadfully limited because of years of underinvestment (uranium price 🚀).

To conclude this section, want to rehash a quote we have used before: In the fight between physics and platitudes, physics always eventually wins. 2024 might be the year the rubber band starts snapping back towards reality.

Money, finance, and the economy

Top stories of 2023:

De-de-dollarization: Our favorite news event of the year was when everyone from Twitter experts and mainstream analysts to local media in various countries was pounding on the “this is the end of the US$ hegemony” narrative. The Chinese Yuan, a BRICS gold-backed currency, or a basket of commodities was apparently going to become the global reserve currency. Even if one doesn’t understand the operations of the monetary system, it’s typically a winning bet to go against such a loud and eclectic majority.

Amid all this confidence, we addressed this topic in a couple of pieces, explaining that once you understand how the system actually works, you can see that de-dollarization is simply not something you can wish or announce into existence. Yes, major countries like China and Saudi have taken measures to diversify away from using the US$ for global trade, but these transactions are not just paltry in size, they also don’t really hurt the US$.

Our take on this is simply that yes, countries do want to decrease their dependence on the US$ given the geopolitical risks, but they don’t want to replace the US$ system. Countries like China are trying to expand the acceptance of the Yuan and build a parallel cross-border payment system not to replace the US$-Swift system, but merely as insurance in case they ever need to use it. De-dollarization — meaning lesser reliance on the US$ for trade and foreign exchange savings — will happen as a result of the global system breaking, but this will be a deeply painful process that will be forced upon most of the world.

This is also tied to the narrative that China is dumping US bonds, which will inevitably spell trouble for the latter. Not only does it make no sense for China to do that, it has continued to invest heavily in US assets, simply switching from bonds to other types of securities.

The inflation rollercoaster & another loss for mainstream economics: In 2021-2022, with the first serious round of inflation in the Global North in decades, analysts were jumping on the hyperinflation bandwagon. “Look at all the government spending, this is going to be terrible for inflation” was common wisdom. Instead, not only did inflation sharply come down in 2023, it also did so without causing a recession!

Let’s think about this for a second: 85% of economists expected a recession in 2023. Larry Summers, former US Treasury Secretary & ex-Harvard President, was calling for “five years of unemployment above 5% to contain inflation” — that means millions of Americans, mostly working-class people, losing jobs!

There’s no data-picking or politicking here. Mainstream economists said one thing would happen, while heterodox economists said another, and the latter were proven right. Why? Because they understand how the real world works and don’t rely on archaic textbook theories and faulty models.

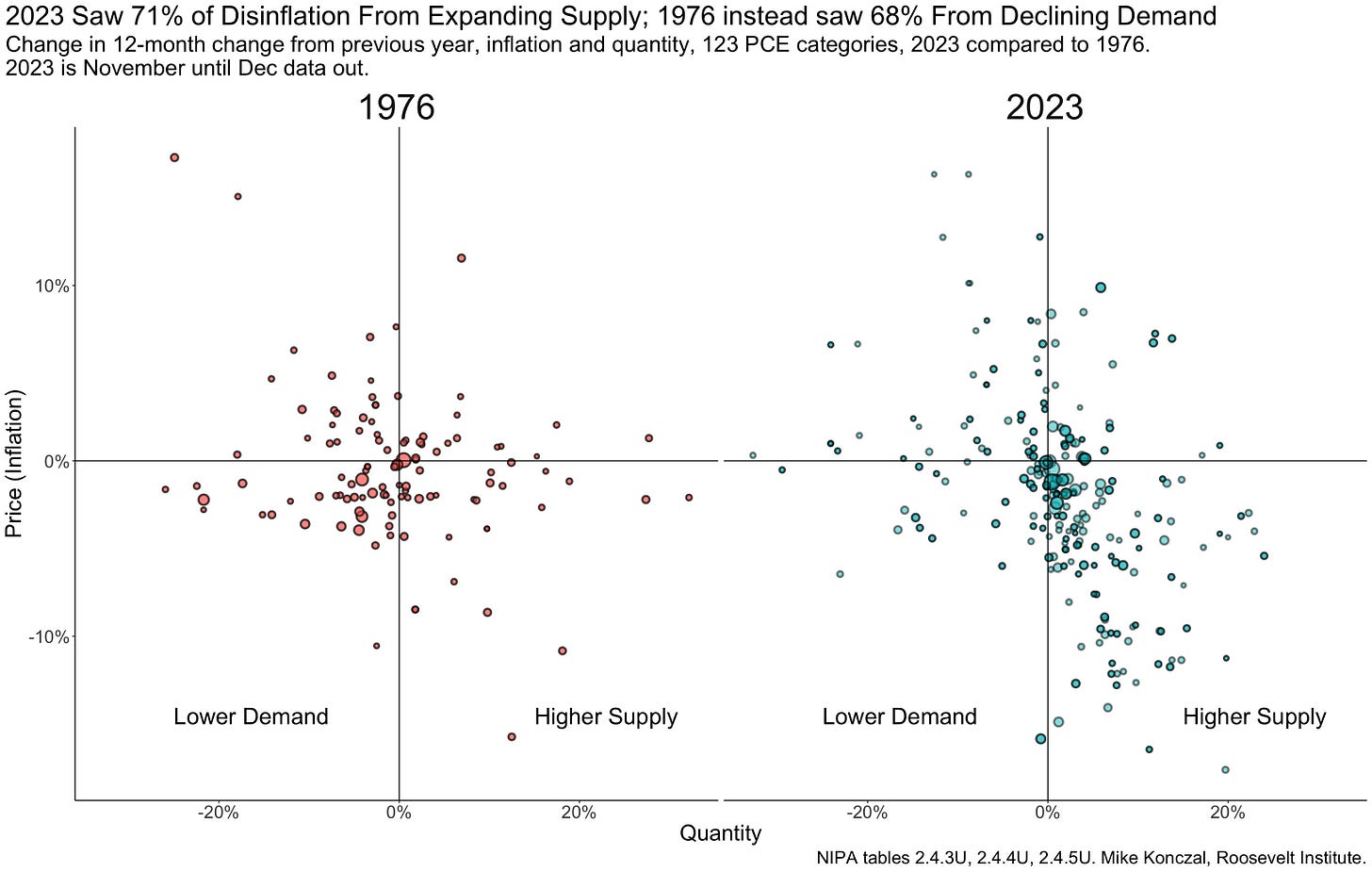

There are two major reasons why the heterodox crowd got it right. Firstly, the inflation was driven by supply-side factors such as manufacturing restarting in a gradual and fragmented way in a post-lockdown world, sanctions on Russia which is a major supplier of oil, wheat and other commodities, etc. Rather than crushing demand through forced unemployment and recession, which is what mainstream economists were calling for, increasing supply and clearing up supply chains was what was needed — and what we got.

Source: Mike Konczal (X) Secondly, high government spending is a huge boost to the economy. Countries like the US that can spend in their own currency rather than borrowing in other currencies (explained in newsletter #5) crowd-in investment through productive spending, which is what the US did with the IRA bill and all the efforts to bring back manufacturing, achieve energy security, etc. This is exactly what Obama did not do in 2008, choosing instead to believe the economic orthodoxy and declaring that the govt had no money to support its citizens, which resulted in a sluggish recovery lasting many years.

The return of industrial policy: For the past 50 years, the one-size-fits-all policy recommendation from mainstream economists and multilateral institutions like the IMF and the WB has been to deregulate, privatize, and loosen trade protections. This has of course been disastrous for many Global South countries and was always hypocritical because it was not how rich countries developed either. Now that the polycrisis is hitting Global North countries and they are desperate to (re)develop, the buzzwords making a comeback are industrial policy, the developmental state, the de-risking state, etc. Basically, after 50 years of preaching the opposite, the state is well and truly back.

There is simply no other way to deal with the challenges of organizing economies to tackle the multitude of crises that we face than for the state to return as a key coordinating actor. Now, this isn’t by definition a good thing either. Daniela Gabor has done excellent work to highlight the difference between the de-risking state and the big green state, in the climate context. The former is what the US is becoming, where state investments and subsidies are focused around coralling private capital into certain sectors (e.g., EV manufacturing) by offering them higher risk-adjusted returns. The big green state, however, is when the state is much more direct in its actions and pushes economic sectors to meet certain social goals (e.g., energy nationalization in Europe, Chinese state focus on advanced manufacturing, etc.).

This trend is just getting started, and countries around the world — including Brazil, Mexico, Indonesia, Malaysia, etc. — are following suit. The various shapes and forms the “industrial state” takes will be something to watch out for, and fight over.

Source: CEPR

As for the top 3 things to look out for in 2024:

Stagflation: There are basically 3 camps in terms of where Global North economies, mostly focusing on the US with implications for the globe, end up. The first one is the “hard landing” camp which predicts a strong recession sometime this year. The second is the “soft landing” camp which believes that no recession will happen and inflation will stop being a problem. The third is the “no landing” camp which believes the economy will be strong but inflation will come back.

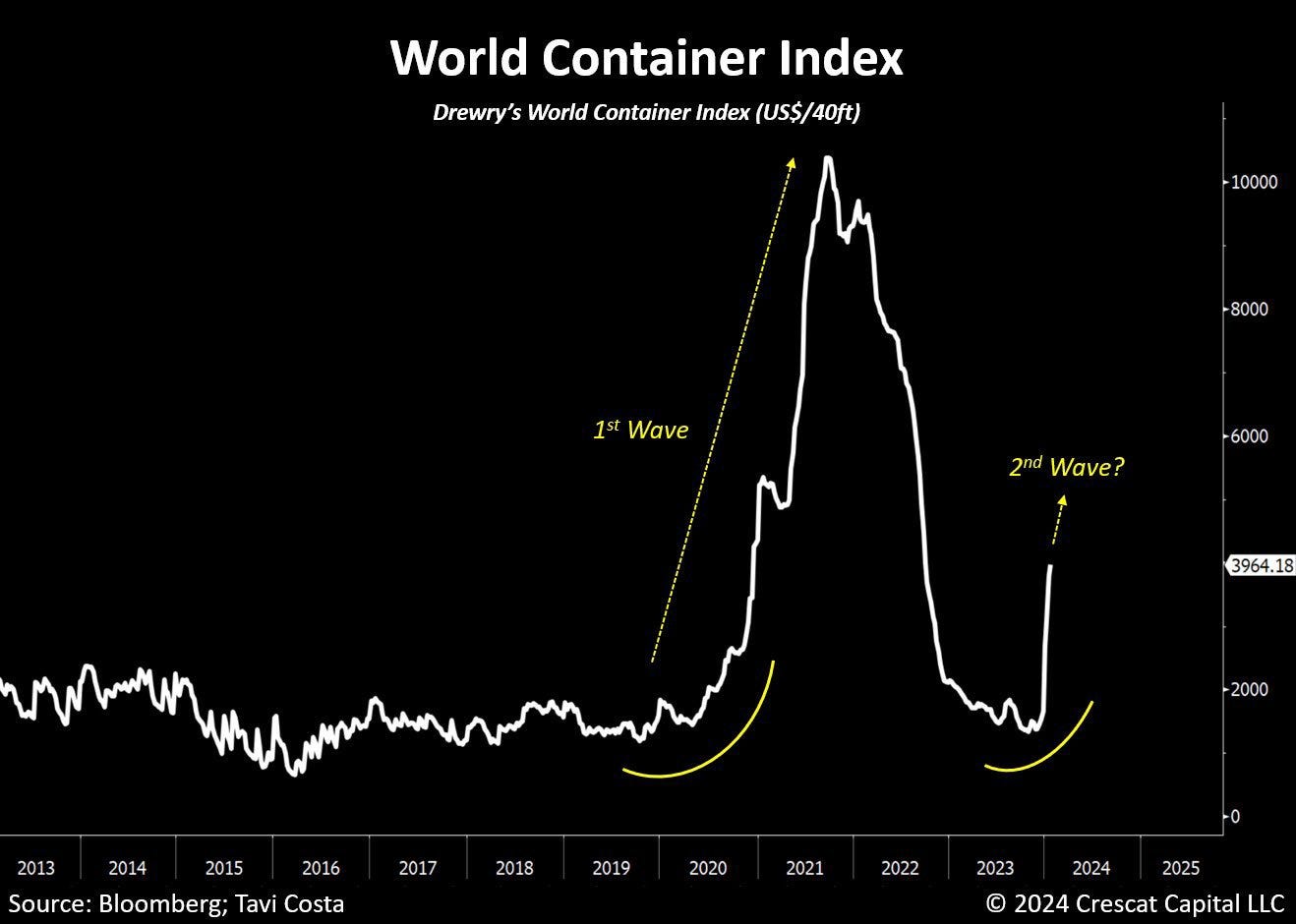

Given the combination of economic factors and geopolitical events, we fall in the no landing camp, which basically predicts stagflation to be prevalent. High GDP growth, relatively strong employment, but a resurgence of inflation. We believe that continuing government spending, particularly in productive areas like energy and manufacturing, will keep the economy strong but supply chain disruptions and potential commodity shortages will send prices higher again.

We mentioned in the first newsletter piece that for the past few decades, we were staunchly in an era of secular low inflation, driven by increasing globalization, access to low cost (exploited) labor, cheap access to energy and materials, etc. Now we have entered a secular inflationary environment because of our surging material needs, geopolitical tensions, brewing financial crises, etc. There will be volatility — and hence bouts of low inflation or even deflation (which is also bad) along the way — but the trend is upwards.

Source: Otavio Costa (X) Global South funding dries up: In 2023 we expected debt crises to start wreaking havoc on the Global South countries, particularly the ones with high foreign debt. For the most part, that did not happen and countries like Egypt, Pakistan, and maybe to an extent Argentina, have managed to hold on — although just barely as they continue to suffer from high inflation & slow growth. However, the causes for our analysis remain at play, including the drying capital that is available for these nations, higher costs to import critical things like food and energy, etc.

Therefore, as geopolitical risks heighten, the system breaks down further, and economic agents become more concerned with domestic issues, funding for Global South countries is going to get much, much tighter. This includes sovereigns being able to borrow, developmental aid funding, VC funding, etc. From the Global South side, higher interest rates, costs of recovery from climate damage, etc. will reduce the ability to raise finance domestically.

This will get exacerbated by the weaponization of funding as rich nations will use it as a means to buy geopolitical leverage, or deliver punishment.

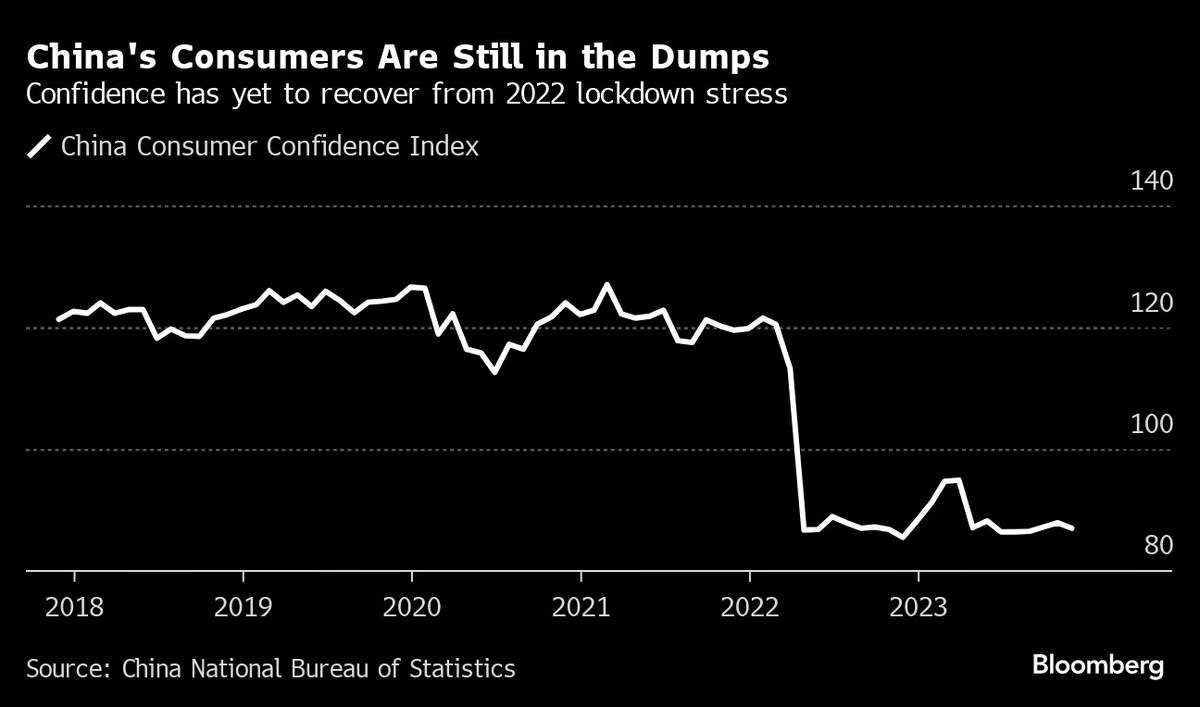

All eyes on China: There is little doubt that China has been the powerhouse behind the global economy for over a decade now. It is the largest consumer of commodities from developing, commodity-export countries, it is one of the largest exporters of goods to many nations, it imports advanced industrial goods from Japan and China, etc. 2023 was a bad year for China, moreso relative to expectations than in absolute terms.

With the end of the zero-Covid policy, investors and economic analysts were expected a huge surge of pent up demand that would drive global growth. This never materialized, and instead, issues regarding their real estate sector and high state government indebtedness continued to dominate the headlines. Those, combined with youth unemployment hitting new highs and a falling population size, have led some experts to predict China is going to follow the 1990s Japan model: a few decades of stagnancy.

However, we believe that 2024 might be the year that China finally recovers economically and drives global growth forward. It has continued to develop robust capabilities in advanced sectors like robotics, AI, EV manufacturing, renewable energy, etc., becoming a world leader in many of the biggest industries over the few decades.

The main challenge for it is that the model that has brought so much success over the past 50 years — which is to focus on export-oriented industrial development — needs to shift to a domestic consumption driven model so that Chinese households can act as a source of demand. Although this is a fundamental rethink of the political economy setup and will be tough to implement, it seems like experts in Beijing have learnt from Japan’s mistakes and are willing to stimulate domestic consumers, not just invest more in production.

Geopolitics & social movements

This piece has gone on longer than expected so we are going to combine the top events of 2023 with what to look out for in 2024.

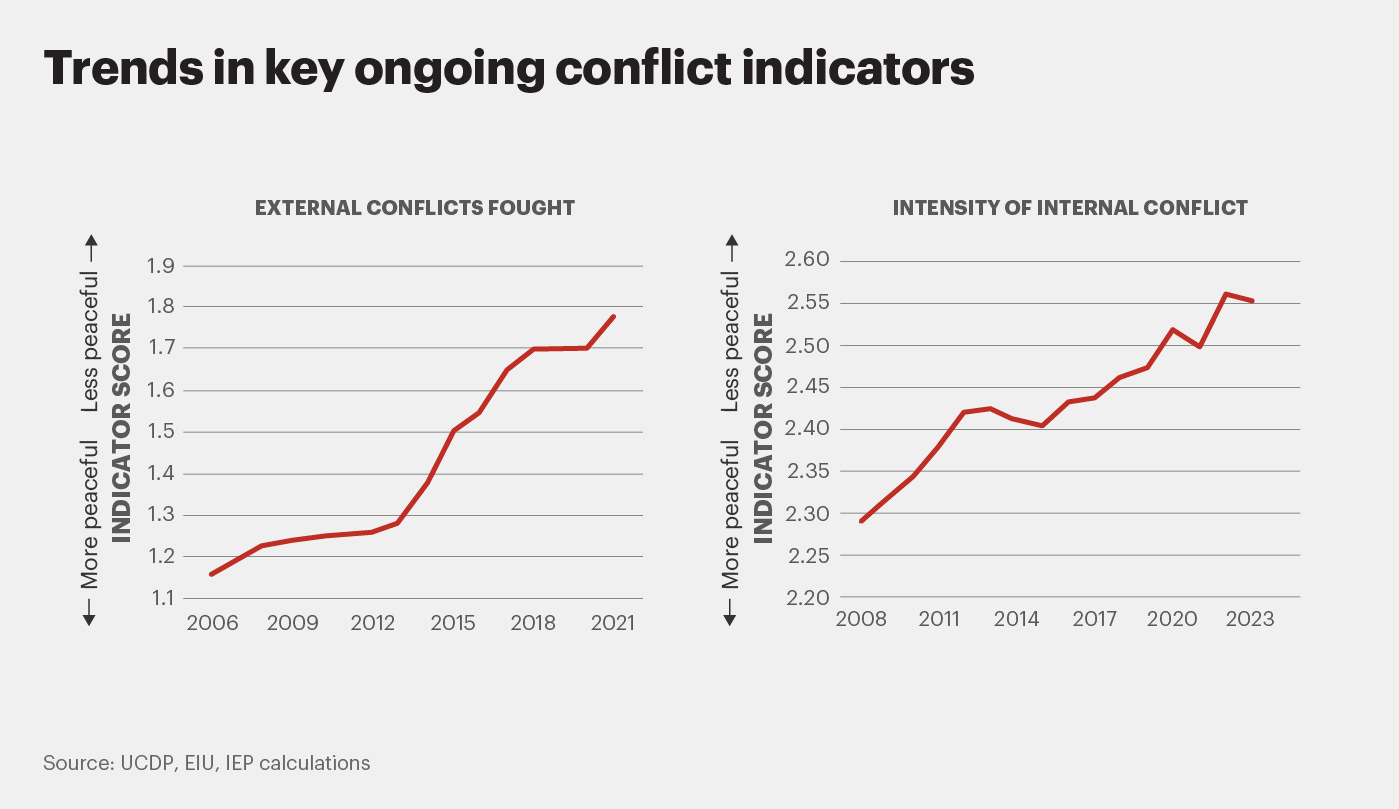

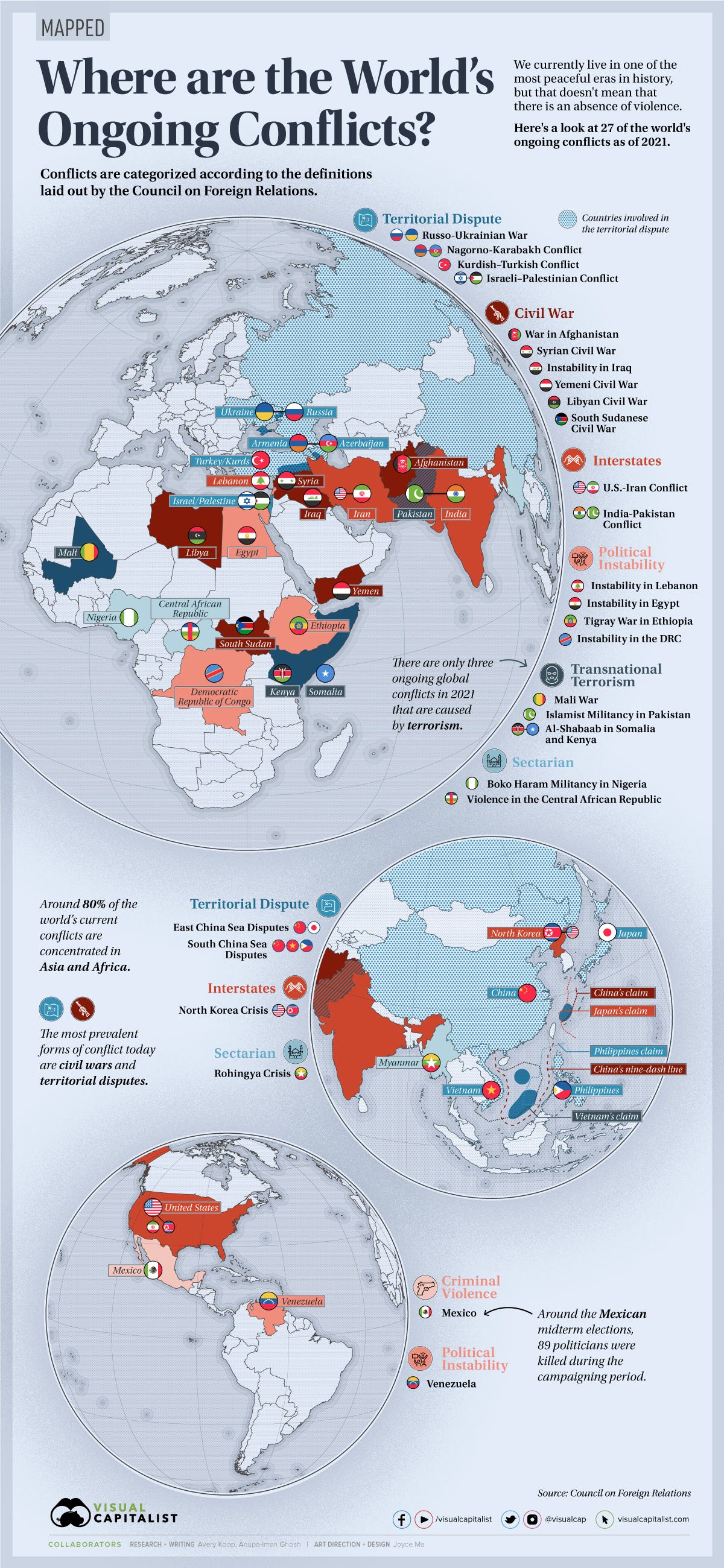

Conflict, conflict, and nuclear risk: Even a cursory glance at the news at 2023 felt like there were constantly new conflicts being talked about. Well, many of them aren’t new. They either just accelerated or the powers that be finally decided to care about them for one reason or another. The genocide against the Palestinians is definitely the biggest news, but we shouldn’t forget the ongoing violence in Sudan, Congo, Armenia-Azerbaijan, Venezuela-Guyana, etc.

The takeaway here isn’t simply that violence is increasing, but what its drivers tell us about where we are going. In many cases, this is related to the point mentioned at the start about a dying system lashing out combined with stresses at the level of energy, food, etc. On the one hand, the existing hegemonic forces are feeling the pressure from all sides. The tried and tested political playbook in such moments tells us that the one that can get domestic constituents to rally behind you is war, and sadly it seems that many nations, particularly Global North countries, are choosing that path.

Whether it is the Sinophobic narratives that have been festering over the past few years, the blind anti-Iran sentiment, or the recent revival of bombings against Yemen, the strategy of creating an us-versus-them is fully at play.

On the other hand, many communities in the Global South are realizing that the promises of self-determination and global human rights are, and always have been, deceptions, and as more communities realities that the system is never going to deliver freedom and justice, conflict will emerge as the only option.

And it is not just conflict. 2023 marked various coups across the African continent, finally revolting against West-favoring regimes that have continued to extract and sell natural resources for cheap while pocketing the gains. Remember, this is intricately tied to the decarbonization and materialization story because many of these conflicts are in resource rich areas.

Lastly, it’s been a few decades since this has been a serious risk, but we should be putting nuclear attacks back on the radar. The US is planning to spend $1.5T on modernizing its nuclear arsenal, China is doubling its weapons, and Russia suspended the last remaining major nuclear treaty with the US. This definitely does not mean a catastrophe is inevitable, and the odds remain incredibly low. However, even minuscule but rising odds about an event at this level of brutality and existential risk cannot be ignored. Don’t forget, it’s happened before.

The biggest election year in history: 60 countries representing about 4B people will be participating in elections this year — a staggering number! Countries like US, India, Pakistan, Russia, Iran, etc. are a part of that list, and regardless of the outcome, the results are going to be monumental in shaping how things turn out. There could be an essay on the dynamics of each country and the broader global implications from those elections, but in short, we should expect a lot more reactionary movements, right-wing forces, and/or militaristic elements to come out as the victors. This is simply because of the thesis mentioned at the start, which is that as societies revolt against the status quo and the liberal elite, the only forces with the grassroots level organization and political structure in place to fill that vacuum are largely right-wing forces. Argentina already presented a good example of that a few months ago.

However, movements always produce their anti-thesis at the same time, and so we are also seeing an increasing emergence of left-wing (again, not liberal) forces. Although in different regions these forces are at sharply different levels of maturity — the strongest being in Latin America — the trend is clear. This is reminiscent of the early 20th century, a period we have been referring to in previous pieces as the best analogy for where we are today.

But in the short-run, this just means more volatility and polarization.

South-South cooperation: The most promising trend has been the reemergence of strong cooperation across the Global South. South Africa taking Israel to the ICJ, countries like Brazil, Bolivia, and Chile being the early voices against Israel, the aid of Yemen, etc. are all examples from just the genocide against the Palestinians about how countries that recognize the system is against them are coming together. Note, what ties these countries together is not religion, ethnicity, or geographic proximity — their bond is based on ideology, which is the only type of bond that can launch a challenge against the status quo.

This is of course not without challenges. Expanding the BRICS by adding Saudi Arabia, Iran, Ethiopia, Egypt, Argentina and the UAE is a promising sign, but these countries have a vast and divergent array of interests, which often collide. The BRICS, and the Global South, are not monolithic entities and hence expecting serious joint efforts from them is futile.

The hope, however, is that across the Global South, there is a recognition that they need to diversity their range of partners, which creates platforms for ideological bonds that do have anti-imperialism and justice at their core, even if the governments of these countries remain embedded in the status quo and at odds with other liberating nations (*cough* Gulf states).

III. Resources

We get asked a lot by people regarding what to read to understand both the specific topics we discuss, as well as the deeper & bigger picture, better. Our answer is typically two-fold:

First, stop reading the people that use the wrong approach, often because it is in their interest to do, so that you can unlearn the mainstream narratives that confine our imagination and depth of understanding. This includes reading airport books by authors such as Yuval Hariri, Jared Diamond, Steven Pinker, etc., as well as mainstream political scientists, economists, and intellectuals like Tom Friedman and co. Oh, and if the person you get your worldview from is often on CNN, MSNBC, BBC, or any other mainstream source, you need to seriously diversify. The track record of these people is not just wrong but nefarious, and its out there for everyone to see and verify.

Second, there is a serious need to explore three types of thinkers:

Heterodox thinkers (and this doesn’t just mean left-wing).

Historians (because there is a lot we can learn from the past as most of this isn’t new)

People who write theory (because that is the deeper layer of understanding that we need to first unlearn and relearn — basically ideology).

Based on that, here is our top 5 list of people to read across a range of topics:

Economics

The fab five economists: Stephanie Kelton, Marianna Mazzucato, Kate Raworth, Claudia Sahm, and Isabella Webber — have not just pushed back against the elite male dominance of economics, they have been right across over highly-contested topics just over the past few years, ranging from inflation, industrial policy, ecological economics, government debt, central banking, etc.

Financial times piece (although it wrongly excludes Webber)

The Economic Consequences of Peace by Keynes: This short, prescient book was written in the lead up to WW2 where Keynes argued that the post WW1 peace was fraught with risk because of how unjust the global arrangement was, and how socioeconomic oppression would breed fascism and future war. Very relevant today.

Big history: Too many mainstream books like Sapiens or Fukuyama’s The Orings Of Political Order or Guns, Germs and Steel rehash the same fictional story about human history — that we went from hunter-gatherers to farmers to city people and developed violence, inequality, and states along the way. They say this because they want us to believe that the world today is the peak of human civilization and we have little to learn pre-Enlightenment (also meaning outside the West).

But that is wrong. The Dawn of Everything by David Graeber and David Wengrow may be one of the most important books of the 21st century because it shows through anthropological and archeological evidence how human history was, in fact, very different, and how ideas of freedom, justice, and rationality are did not suddenly emerge in Enlightenment Europe but can be found in Native American and other cultures.

This is the type of book that is essential to read to expand the horizons of what we think is possible with society today, where to find inspiration from, etc.

Plus, Graeber was a powerhouse intellectual and we highly recommend his other work too.

Theory: No one better to read for the predicaments we face today than Antonio Gramsci. He was writing in a time that we think is the best analogy for the state of the world today and offers incredibly incisive analyses on how change happens, how hegemony works, etc. Although a Marxist, many of today’s right-wingers actually apply Gramscian principles on how to fight the status quo and gain power.

General principles & thinking: It’s hard to even classify him in a bucket if Nassim Taleb is one of the greatest intellectuals alive today. His work debunks myths left and right, including IQ tests, modern statistics, behavioral economics & psychology, risk management approaches, etc. But his work is essential just to understand everyday concepts in the world that we all encounter daily: probability, chance, randomness, risk, etc. His Incerto series of books is designed for a general audience — cannot recommend it enough. We may live in an information age, but as Taleb shows, that just puts us more at risk at a false sense of understanding.

Neuroscience, philosophy, etc.: Also hard to bucket, but in a world with rapid changes and powerful new forces like AI, Ian McGilchrist & Daniel Schmachtenberger offer profound new ways of thinking and decision making. For them, we are the most powerful civilization in human history but also the most lacking in wisdom — a highly dangerous combination. Their work really makes you see your own approach to the world differently.

What a perfect summary. Your work is always impressive, well organized and to the point. I have been riding this train of thought intellectually and intuitively for decades. I'm enjoying seeing more and more people developing these perspectives. This is indeed an exciting trend. I hope to hear from anyone who readily understands the Fictitious Capital project. Spinoza's God's Speed! We will all be forced to react to the great dictator, "Circumstances," but at the very least our reactions may be better measured and less full of horror and panic if we take these ideas on board. https://www.cospolon.eu/book-recommendations