#19: Holding a bag of rocks

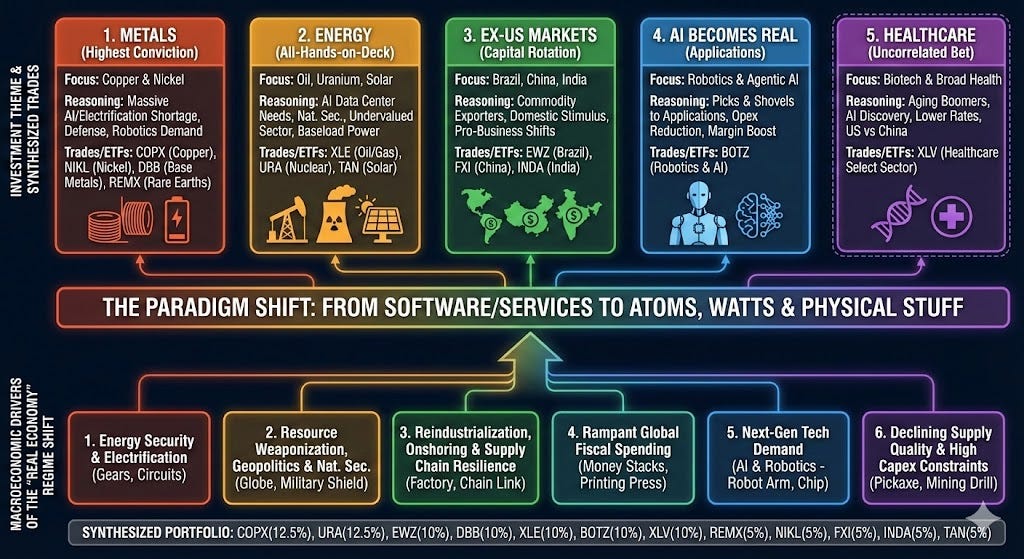

Opportunities in the era of dispersion, trend changes, and bubbles.

One of my personal reflections of 2025 is to become better at putting my money where my mouth is. And I mean that literally.

Despite writing multiple pieces on deglobalization, resource weaponization, raw material and energy demand (esp FFs), and supply issues, I’ve remained woefully underinvested in Gold, Silver, Copper, Platinum, etc. – where commodity prices are up 2x, 3x, 1.6x, and 2x since Jan 2024, respectively.

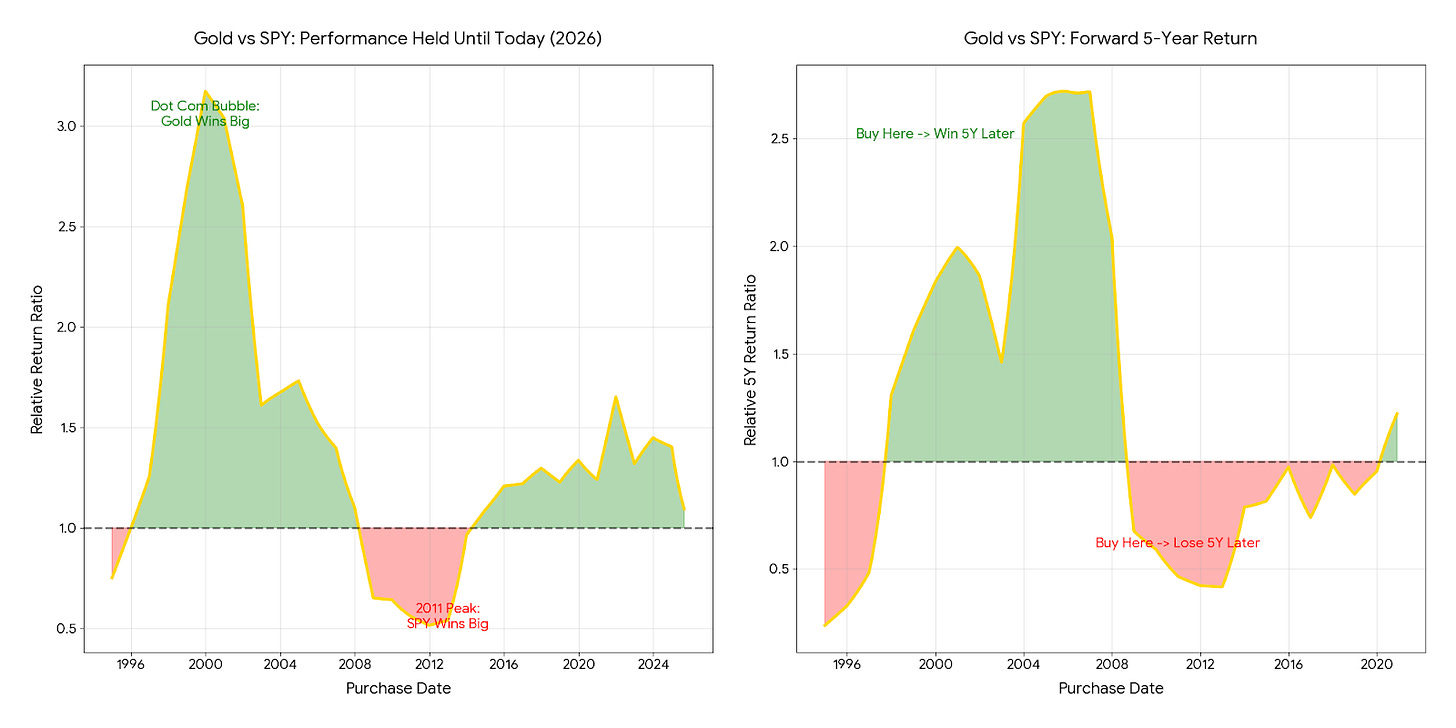

Btw, counter to popular opinion, Gold has been a better long-term investment than US equities for most of the past 30 years (left chart), while also becoming a good medium-term investment recently (right chart).

This piece is an attempt to articulate my overarching theses into clear investment theses.

My general investment approach is the following: passive investing into index funds will be insufficient for wealth creation for a variety of reasons, which I will cover in the next piece. Some of those include a higher rate for inflation, which dampens real returns, market concentration into mag7 tech stocks, hyper-financialization, and the continued rise in speculative retail trading (I’ve had multiple Uber drivers trade while driving), and the breakdown of the global US$ system that favored US assets.

This isn’t a bearish outlook.

Instead, to no one’s surprise if you’ve read my earlier pieces, I think the real economy — referring to physical stuff like commodities, energy, industrial output — is set to outperform the broader market, which has been dominated by tech over the past 15 years.

Jeff Currie calls this “The New Joule Order”. Many others have been talking about the commodity supercycle for multiple years (this old Zoltan Pozsar piece is interesting too). At this point, it’s not a novel concept, but one of the things I am learning now is just how much inertia there is in changing legacy, institutional behavior, especially towards something like investing.

There are 6 overarching drivers of my worldview:

Energy security + electrification

Resource weaponization + geopolitics + national security

Reindustrialization + onshoring + supply chain resilience

Rampant fiscal spending + running the economy hot globally

Next-gen tech (AI, robotics, etc.)

Declining ore/reservoir quality + high capex requirements for supply expansion

Some people might think these trends have already gone mainstream, given the price increases I mentioned above, but we’re talking about a multi-decade regime shift. The charts below illustrate just how much room there is to cover — potentially.

Metals & mining ETF vs SPY

Copper vs Gold

Emerging markets vs US stocks

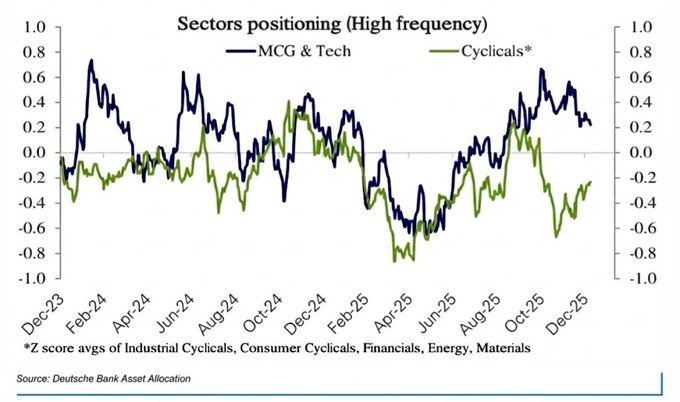

Investor positioning data shows the same. People are not invested to benefit of these themes yet. In the many conversations I’ve had with people from different parts of the world over the past few months, none mentioned commodities or cyclicals as part of their portfolio. Everyone is either looking to get into the AI trade or waiting for the bubble to burst.

Lastly, this isn’t financial advice, especially because expressing investment ideas is the best way to jinx them 🚨. The point of this piece is just to present ideas to diversify your portfolio. This is also a US midterm election year within a broader historical transition period: volatility wrapped in volatility. Do with that what you will. Most successful investors only have a 50-60% win rate.

Without further ado, here are the 5 investment themes.

1. Metals

While Gold and Silver will continue to be essential investments, the main story here is now Copper.

There’s no doubt that there is going to be a ginormous shortage of copper. The persistent global AI boom, reshoring manufacturing, defense spending, and securing supply chains all require a massive expansion of electrification, which is heavily dependent on copper. Also, the recent price increase in Silver, if sustained, would also encourage substitution towards copper.

Here’s what the White House had to say about copper in July 2025 (emphasis added by me):

“...the Secretary found that copper is essential to the manufacturing foundation on which United States national and economic security depend. Copper is the second most widely used material by the Department of Defense and is a necessary input in a range of defense systems, including aircraft, ground vehicles, ships, submarines, missiles, and ammunition. Copper also plays a central role in the broader United States industrial base. The metal’s exceptional electrical conductivity and durability also make it indispensable to critical infrastructure sectors that support the American economy, national security, and public health. Alternatives to copper are insufficient substitutes for these vital industries and products in many circumstances.”

On top of all this, my perspective is that the global robotics industry is underappreciated right now, which will be a major additional source of demand.

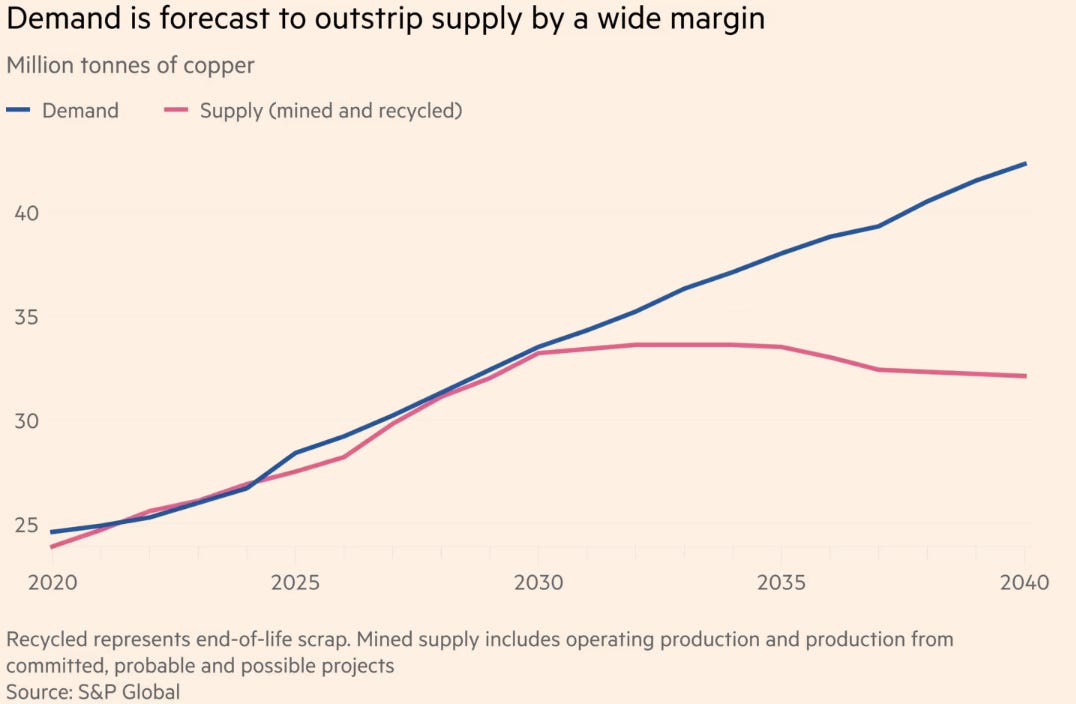

In terms of availability, a new report estimates a 25% gap between demand and supply by 2040 due to a 50% rise from current consumption levels and ongoing issues with enhancing supply (e.g., ore quality, capex requirements, resource concentration in a few countries, etc.) – this accounts for improvements in recycling capabilities. Many reports over the past few years have validated this dynamic.

Source: Financial Times

Why is this a good investment thesis now?

From the market’s perspective, such opportunities get priced in years in advance – no one is going to wait for the 2030s. From an industry perspective, the race to secure copper supply is already on, exemplified by the trade war between the US & China.

From a technical perspective, Copper also looks set to follow Gold and Silver. Price has been consolidating for 5 years above the moving averages and is now breaking out, similar to how Gold behaved the past 2 years.

⚠️ On the flip side, the big risk is that everyone is starting to talk about Copper. And everyone can’t be right. So expect volatility as this secular bull market plays out.

The next individual base metal that could have sufficient upside, and one that hasn’t attracted mainstream attention yet, is Nickel. The bullish case isn’t clear-cut here because, unlike Copper, Silver, etc., Nickel is an oversupplied market with Indonesia (60% of global supply) continuing to ramp output while China (~60% of global demand) is becoming substantially better at recycling while also moving away from high-Nickel EV batteries towards Lithium Iron Phosphate (LFP) batteries.

However, this narrative presents an interesting, albeit early, opportunity. The three main bullish drivers that should be watched out for are:

China’s influence: Like with almost every other base and critical metal, China dominates the industry, including Chinese companies in Indonesia. With that leverage, and the recent stockpiling of high-quality Nickel, geopolitical tensions being played out in the Nickel market cannot be ignored.

Surging demand: Despite the increasing switch to LFP batteries, Nickel is still critical for long-range batteries and batteries produced outside China. Also, it is replacing Cobalt within Lithium-ion batteries, given the major supply issues for Cobalt (cost, human rights, etc.)

Supply shocks: Indonesia could reduce its supply to boost prices, while tariffs and supply chain breakdowns in a market with limited suppliers and refiners present opportunities for price volatility, especially when the narrative is so skewed towards a supply glut.

In technical terms, Nickel miners are breaking out of a 2-year price consolidation and are well above the weekly moving averages.

Lithium is another one that looks interesting, but I won’t get into it here.

More broadly, these theses apply to base, industrial, and rare earth metals in general.

This industry has gone through a decade of market consolidation, with weaker miners being forced out due to stagnant prices and considerable M&A activity, all of which has forced operational streamlining, lower costs, and stronger balance sheets. There is also a reluctance to invest in capex – this is one of the lessons companies have learnt after the commodity bull market in the 2000s, meaning supply will be harder to expand. Even if they did, mining takes time, the refining and supply chain infrastructure takes time, and ore quality is decreasing.

However, that is a multi-year thesis, so the short/medium term risks that come with a commoditized, demand-supply driven, speculation-prone market should not be ignored.

In technical terms, price is breaking out of a multi-year consolidation (within a multi-decade consolidation), so the risk-reward potential is clear.

ETFs:

Broad: XME, DBB, REMX

Copper: CPER, COPX

Nickel: NIKL

Lithium: LIT

Note: Metals are my highest conviction theme, so I will go through the remaining themes more concisely to avoid this becoming a long piece.

2. Energy

Global oil prices went from negative in early 2020 (Covid) to a cycle top of $100+ in early 2022 (Russia-Ukraine). Since then, energy resources have been probably the most important topic globally, impacting geopolitics, domestic politics, capital flows, etc.

The thesis here is quite simple: energy has always run the world, but with the rise in inflation 3-4 years ago, the resurgence of national security issues, the trends discussed above about electrification, AI data centers, and manufacturing, etc., it’s an all-hands-on-deck situation.

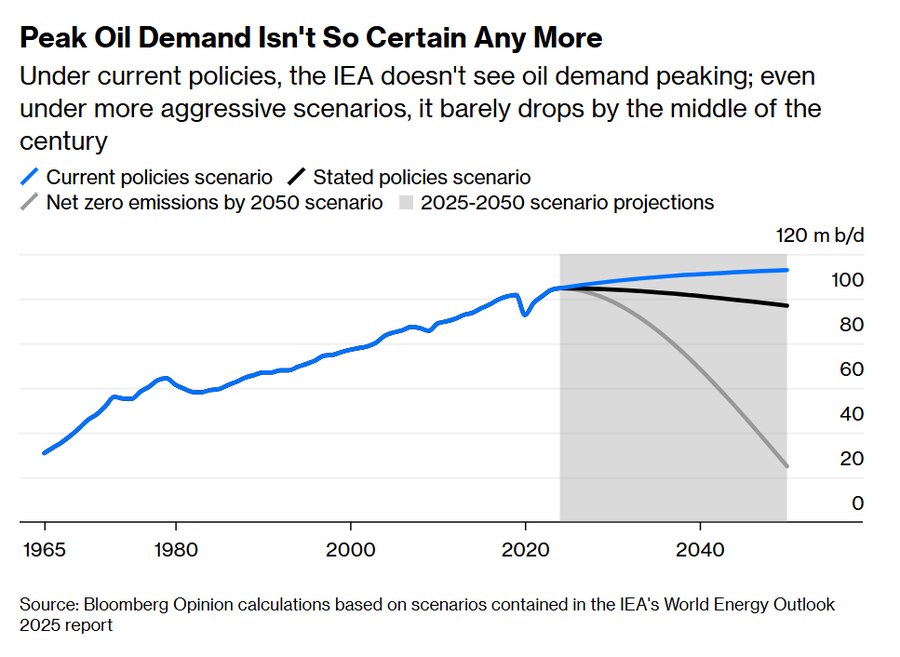

Fossil fuels aren’t going anywhere – they’re simply too embedded in our modern way of life and political economy. The IEA expects demand to grow at 1.4% annually till 2050, largely driven by petrochemicals and jet fuel. Read my primer on oil to better understand how the oil market works.

Recent US administrations have done a good job of using state capacity to ensure that oil prices remain stable, which is largely why inflation has come back down, despite tariffs and other issues. However, breakeven prices for the US shale industry are rising – and shale is what has positioned the US as an energy secure and the largest oil producer in the world.

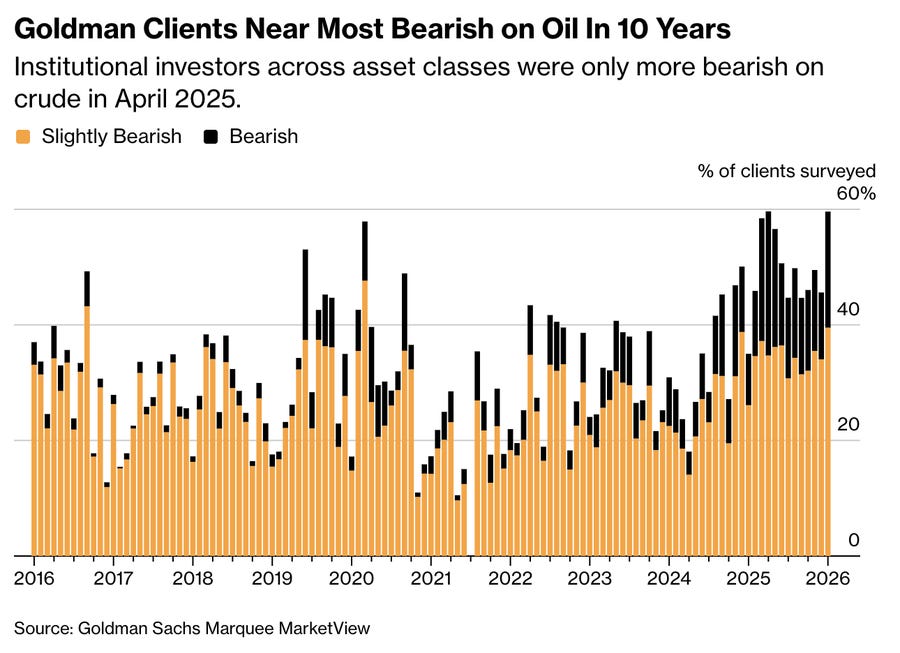

The real driver of this thesis is that the oil sector is grossly undervalued, with investors largely short. Mainstream narratives are focused on an oil glut, especially now with what happened in Venezuela and the large but economically unviable reserves there. That’s what creates an asymmetric, although hard to time, opportunity here.

[Btw, don’t trust the talk about Venezuela's oil reserves — sourness of the oil, the amount of investment needed to expand production, etc., are huge limiting factors]

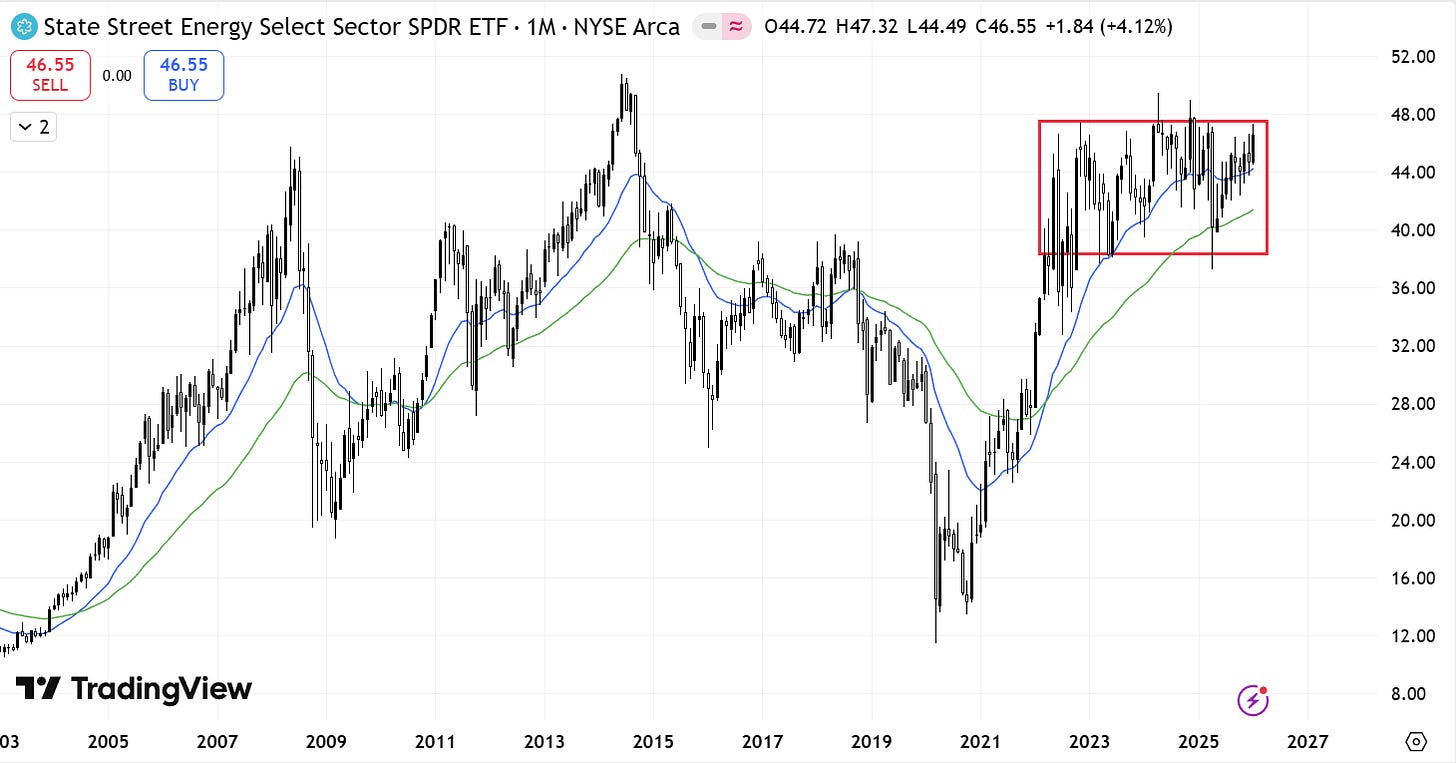

You can see that in the price chart, where the sector has been consolidating for 4 years while the rest of the market has gone higher. There’s a lot of pent-up energy to fuel this trade once it gets going – but it could take a while.

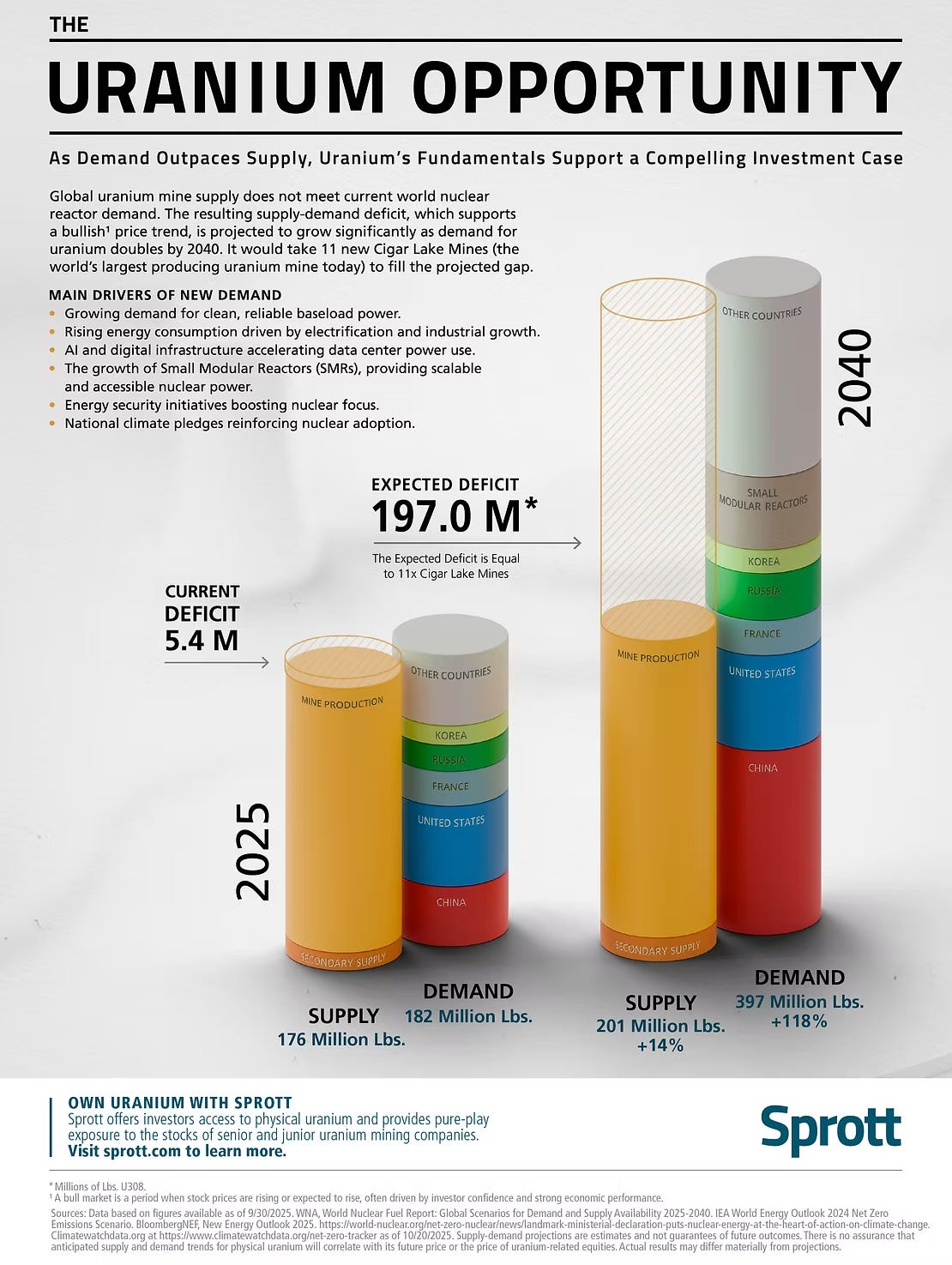

Next up is Uranium. Nuclear is an incredible resource for a reliable, clean, and ultimately cheap electricity system, especially given the electrification surge. Given that, it’s not surprising that Uranium was added to the critical minerals list by the US govt in 2025, which means the government is going to get behind securing supply chains and building out this sector. Demand will roughly double by 2040 while supply will inch higher; it’s really hard to expand and expensive Uranium mining.

Do we get a Strategic Uranium Reserve, similar to the Strategic Petroleum Reserve? It’s possible.

This is also another area where China is quite far ahead, with countries like the US desperate to try to catch up, so expect significant government investment and protective measures.

The price chart confirms the opportunity. After a decade of low prices, we saw a 4x jump to touch the all-time high price, followed by a 2-year consolidation (look up cup-and-handle patterns; you can also see this in the Gold chart). The miners, however, are still digesting the new market dynamics and aren’t even close to their 2011 highs.

The last one here is solar. It gets a lot of hate from the anti-renewable crowd, but there’s no doubt about how critical it is as a resource – it’s super cheap, quick to install, modular, and decentralized. Solar + batteries is a combination that is hard to beat, especially given issues with grid interconnectivity and the speed at which power needs are growing.

Also, it seems counterintuitive, but when President Trump was in power last time, solar did pretty well at the end, especially when energy security started becoming important. So, given the all-hands-on-deck approach towards energy, the probability of lower interest rates (solar is highly sensitive to rates), and sentiment being neutral, seems like a decent opportunity.

In terms of price (looking at the Solar ETF), it’s just creeping above the moving averages and trying to overcome a historically critical level. It may chop around, especially as the market figures out the interest rate path with the new Fed chair and midterms, but the upside reward here presents a great opportunity.

As a bonus, I think coal also looks good here.

ETFs:

Oil: XLE & OIH

Nuclear: U.UN & URNM

Solar: TAN

Coal: COAL (Coal)

3. ex-US markets

One of the features of the post-GFC 2008 era was that US equity markets sucked up global capital and outperformed the rest of the world. For many reasons, with US industrial policy being the main one, the forces that led to this outperformance are shifting. 2025 was the first year in a while where emerging markets outperformed the US, and I expect that trend to continue, given that it’s still the early innings of the shifting global trade and macroeconomic regime.

The countries I am looking at are:

Brazil: There are 3 simple tailwinds. Firstly, it’s a major commodity exporter, so all the raw material dynamics talked about above apply here. Secondly, it has a huge domestic market, which facilitates economic resilience and innovation (e.g., e-commerce & fintech are rapidly growing sectors). Thirdly, Latin America is seeing a pro-business shift that is attracting global capital — think US geopolitics in the Western Hemisphere, the importance of this region for supply chains, etc. While I politically disagree with the developments, the tailwind is there. For Brazil specifically, stocks did really well even when Lula was in charge in the 2000s, so the odds of success seem quite favorable.

China: It doesn’t even need to be said that China is by far the most advanced country in the world. Its stock market, however, had gone sideways for over a decade due to razor-thin margins, capital flowing into R&D rather than buybacks, and low consumer spending. Now, with the Chinese government slowly moving towards boosting consumer spending through large fiscal stimulus, and more China hawks realizing that true decoupling with China isn’t really possible, this market presents an interesting opportunity.

India: This one is mostly based on vibes. 2025 wasn’t a great year for India – it’s fallen way behind in the race to be a globally competitive superpower, the AI trade sucked capital and attention away from the SaaS offshoring that India was absorbing, and geopolitically, the fanfare has quieted down. The fundamentals haven’t changed much though. As an emerging market, it’s still a major player, so I expect it to be a destination as capital seeks return globally.

In terms of the charts, Brazil is coming out of a decade-long consolidation and has considerable room to even reach its all-time high price.

China is still within its 20-year sideways price action, but for the first time, the moving averages are now trending upwards.

India is consolidating after an impressive move in 2023-24.

ETFs:

Brazil: EWZ

China: FXI, KWEB

India: INDA

4. AI becomes real

Isn’t the AI trade a bubble!? Meh. There are many fundamental reasons why this AI cycle is substantially different from the dotcom bubble (but potentially similar to the railroad, electricity, and shipping container trends – more on this in the future). So while valuations are rich and the hype is non-stop, I think moving from the foundational picks and shovels (semiconductors, memory, etc.) to AI applications is more likely than a dramatic crash.

The two main applications I am looking at are robotics and agentic AI.

Robotics: Watching XPENG’s CEO cut through the skin of its robot to dispel rumors that there was a human inside was a surreal moment. For a non-technical person trying to keep up with AI, that’s the moment when it felt that something truly revolutionary was potentially around the corner. While there have always been lofty figures floating around about how opportunity lies with robotics, it doesn’t seem like the market realizes that this could be closer than we think, especially in countries like China. The tide is slowly turning, though, so this could be a great opportunity to get in relatively early.

“The ChatGPT moment for robotics is here.” — Jensen Huang (2026)

Agentic AI: My thesis is simply that companies will start to integrate AI into corporate workflows, which will dramatically lower costs and reduce timelines. When the market questions how companies will generate returns to justify the exorbitant capex spend, this will be a good answer. It might not be as glitzy as a new consumer offering that drives revenue, but lower opex and margin maintenance would be just as important. I bet that the earnings of SaaS companies, at least those that can implement AI effectively, will start to reflect this in 2026.

“Our researchers say attention is starting to shift to companies in other phases of the AI trade, such as companies with the potential for AI-enabled revenues.” — Goldman Sachs

This theme is honestly hard to implement through ETFs, given the breadth of the topic and wide disparity across companies, so I won’t do technical analysis.

ETFs:

Robotics: BOTZ

SaaS (proxy for agentic AI): IGV

5. Healthcare

There were multiple sectors I was looking at for the fifth theme — including industrials, consumer discretionary, and agriculture, all of which people should consider if they’re interested — but ultimately settled on healthcare because it seems the most uncorrelated to the other four themes.

Think about this for a second: if you exclude healthcare, job creation in the US would’ve been negative in 2025!

That’s how important yet underappreciated the sector is.

The tailwinds here are clear:

Boomers are entering old age, which is when healthcare expenditure typically rises. It also doesn’t hurt that boomers are a relatively rich generation, so they’ve got a lot of money to spend.

AI is enabling breakthroughs, filling in resource gaps, and reducing costs for drug development, caregiving services, etc.

The US is realizing that China poses a serious threat to its dominance in biotech and drug development.

Lower interest rates will help as many companies in the space are smaller and rely on funding for many years before they have a commercially viable product.

The current administration has a bias towards health innovation, longevity, cutting regulations, etc.

Not to say that there aren’t major risks, most notably the fact that there’s growing social pressure related to healthcare costs, so government action to limit prices and other pro-people regulations would hurt certain companies in this space.

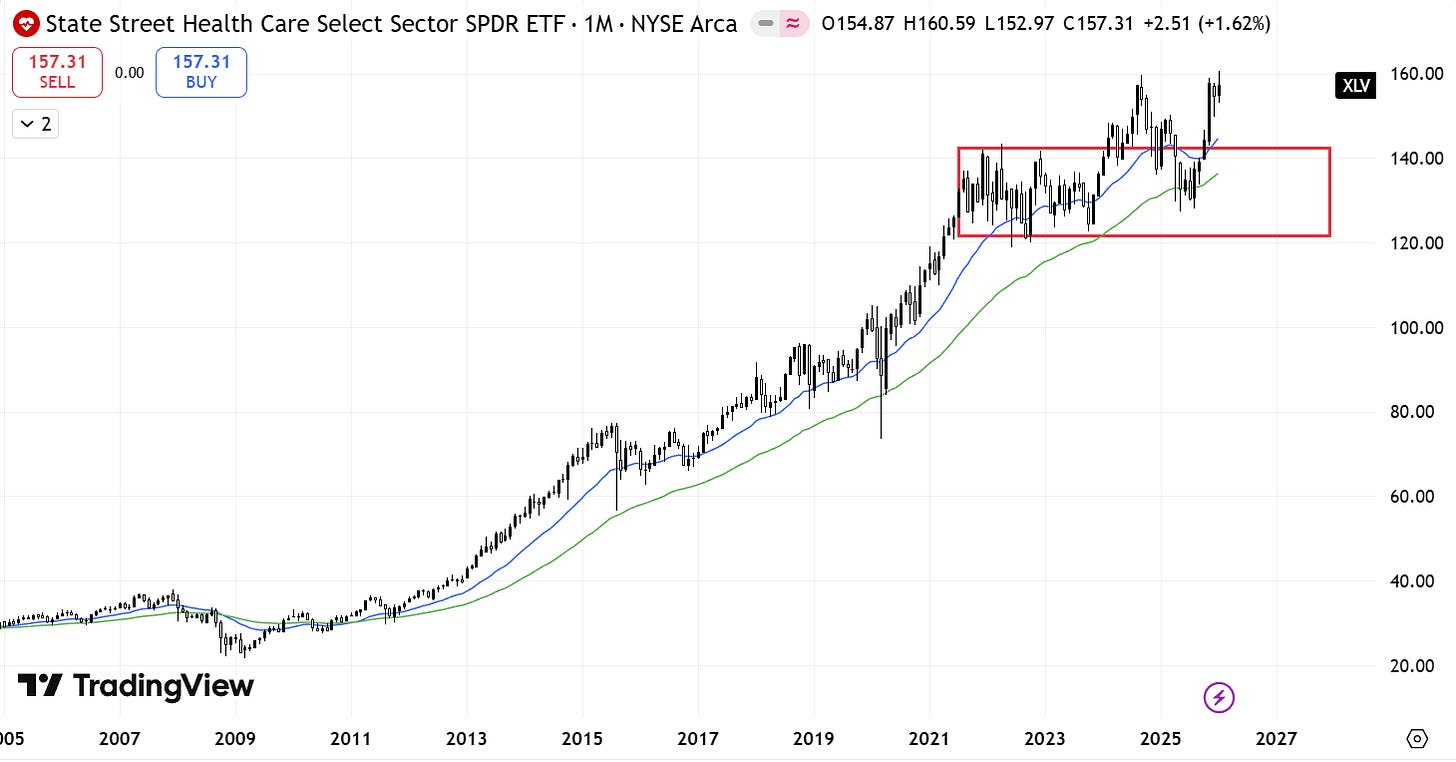

Overall though, the tailwinds seem to outweigh the risks, and given that this sector is trailing the broader market in terms of performance, it’s likely a good time to be an investor.

You can see in the charts that the broader healthcare market has been consolidating for 5 years and looks close to breaking out, while the biotech sector (high-beta, more volatile) broke out of a 4-year price consolidation (maybe even a 10-year consolidation if you’re not too picky).

ETFs:

Healthcare: XLV

Biotech: XBI

Industrials: XLI, XLB

Ag: MOO

Conclusion

Rematerialization, reindustrialization, deglobalization, and decarbonization — they’re all centered around commodities, both raw materials and energy resources, and global decentralization.

As I’ve argued before, this is a paradigmatic shift from the software / services-heavy world we’ve become reliant on, where the atoms and watts that run our civilization were largely ignored. But as always, they’re back. Physics underpins our sociopolitical reality.

Let me leave you with 2 thoughts:

Regime change is messy; take profits: We’ve lived in a world where US equities, and more specifically US tech stocks, were dominant. It became an easy investment. Right now, we’re just seeing the early signs of that rotation towards commodities and emerging markets, so expect this to be a grind, with lots of pullbacks, slow periods of consolidation, and face-ripping moves. You can’t time it; you just have to have a clear thesis and stay the course till proven otherwise (this is why I didn’t invest in Silver cause I always felt I had missed the move). In volatile times like now, crazy headlines dominate the airwaves, and everyone’s got their finger on the buy/sell button, especially algos. Tune out the noise, take profits along the way, and keep learning.

Fade the extremes, eventually: The majority is always wrong. I’ve said that about politics and other topics, but it applies almost mechanically in financial markets. When sentiment gets euphoric, when everyone seems to be on the same bandwagon, it’s time to take a step back.

On a longer timeframe, I don’t think we’re there yet, even with the incredible moves in Gold and Silver. Nor do I think the AI trade is done because everyone is looking for the bubble to burst.

Just think about it, how many people do you know who are putting part of their portfolio in commodities? How many 401ks give that option? How many pension funds are doing that? How many people think geology and mining are cool topics?

However, there will be interim, short-term moments of euphoria that will inevitably arise. People will talk about how they found the next big metal miner and doubled their money in a week. Expect sharp bearish moves to wipe out speculators and reset sentiment.

“When I see a bubble forming, I rush in to buy, adding fuel to the fire.”

— George Soros

The sample portfolio I want to track for this year:

COPX (12.5%)

URA (12.5%)

EWZ (10%)

DBB (10%)

XLE (10%)

BOTZ (10%)

XLV (10%)

REMX (5%)

NIKL (5%)

FXI (5%)

INDA (5%)

TAN (5%)

Let’s see if we can beat the market!

Resources

Revenge of the Old Economy & How to Invest in the Commodity Supercycle | Jeff Currie

Commodities & Cyclicals Are 2026’s Mega-Cap Tech

Very interesting and timely read! With gold prices rising, seems like our south Asian grandmothers are doing a better job at beating the market 😁 I look forward to the next piece on ETFs!

Hi, I see a lot of startups and alternative ideas failing. Prices are rising and demand is falling. Don't you think that's a bit too optimistic, even considering the initial bearish trends and consolidation?

Too much volatility and irrationality ahead.

The best investment is fresh water.